Automated Accounts Receivable: Introduction, Benefits & Best Practices

Do you find it hard to get the time to pursue consumers for payment or spend a lot of time in bulk manual management tasks? Then it's time to upgrade your systems and go digital.

A manual accounts receivable system is time-consuming, inefficient, and has human errors too.

Two things that a customized, automated accounts receivable automation system will help you with are:

1. Saving time on manual tasks.

2. Avoid silly errors during documentation.

Be it is a small-owned firm or any global company, they understand that a profitable business cannot be successful unless its finances are properly managed. The cash flow of a company is its lifeblood and at the heart of it is to clear the payment dues on time.

Thus, the accounts receivable process is an essential component of making sure everything is running well. Marketing, sales, customer service, and overall operations all benefit from a streamlined and effective AR process. As a result, investing time and effort to develop it is worth it.

What is the Accounts Receivable?

If any company has Receivables, it means it has made a sale but has not yet received payment from the buyer. Account receivable, or AR, is money owed to a business for goods or services delivered but not yet paid for.

Simply put, receivables are money that comes in and payables are money that leaves. The overdue payments are shown on balance sheets, and a lot of repetitive data entry is necessary.

Efficient accounts receivable management ensures a healthy cash flow by bringing cash into the business before an invoice is due or becomes a bad debt. An accounts receivable automation system eliminates the danger of human error, such as typing errors and document misplacement.

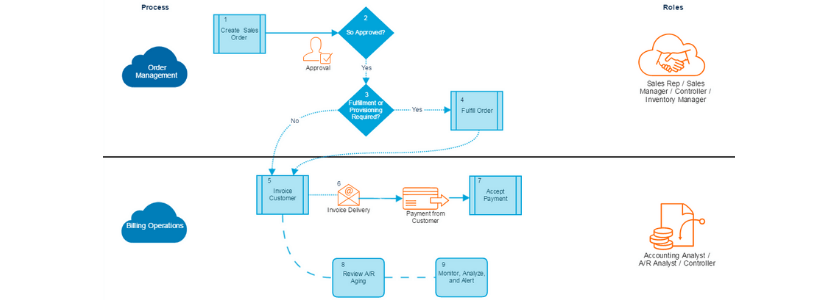

Accounts Receivable Process

A company must set up an Accounts Receivable Process to identify its customer's payment status with ease. The procedure is a straightforward series of activities that allows you to track and manage your receivables. However, because of economies of scale, the approach for large and small businesses may differ.

Because major companies have more cash on hand, they often invest in highly trained credit management teams and IT technologies to help improve and manage the process.

The following is an example of a typical invoice status life cycle:

Invoice Generation

Invoicing is necessary for accounts receivable. The invoice is a required document that details how much a consumer owes for a product or service they received from a business. The invoice should clearly state what the client is paying for, the period during which the goods or service was supplied to the customer, and the due date by which the customer must pay their balance.

For simple retrieval, each invoice must have its invoice number. Following that, the customer is offered the option of receiving electronic or physical invoices. The longer it takes for a corporation to send an invoice, the longer it takes for a consumer to pay.

As a result, make sure your company is sending out bills on schedule. Steps like promoting annual memberships (rather than monthly) can also help sustain a stable cash flow.

Reporting and Analysing

Account receivable reports show how much money you owe to your customers. An Accounts Receivable Aging Report is the most typical sort of report for reviewing account receivables. It is designed to make and filter outstanding invoices by past due dates simpler and accurately estimate the total debt owing to the company.

This report will assist you in determining how your customers' businesses operate and aligning your invoice timing with theirs will ensure you receive payment on time. It will also enable you to withhold product or service offerings until the consumer has paid the outstanding balance by the due date.

The AP department creates and examines spreadsheets in Excel or a comparable tool, assessing all transactions and keeping track of the department's performance and KPIs, such as days payable outstanding (DPO). It will ensure that you do not lose money by offering a service or product without receiving payment.

5 Benefits of Automated Accounts Receivable

Manual data entry is time-consuming and labor-intensive. Using an automated accounting system relieves you of this burden. Business executives and accountants may get more hang for their money with automated solutions, which means less effort and stress for greater results.

Based on simple data input, automated accounts receivable process software can generate bills, send reminders, and generate lists. They can work with a variety of payment methods, including credit cards, bank transfers, and payment portals.

1. Saving time and human effort

The formatting of papers and duplication of effort is eliminated when your accounts receivable processes are automated. AR software that is automated will have a superior workflow, fewer human mistakes, improved employee-customer communication, and better time management. Account information can be automatically supplied on your digital documentation, eliminating the need for back-and-forth account information, which would otherwise cause the payment process to be delayed. Even Invoicing is more accurate with automation.

With all of the invoice data in one location, analyzing receivables takes seconds, and the process is more transparent and efficient. Faster payments and fewer bad debts are guaranteed with well-oiled automated ERP software for AR.

2. Out with the old

Imagine having to lug around expensive documents while attempting to be efficient. Manual methods can wreak havoc on cash flow, limiting corporate growth, meeting business objectives, and generating overall income.

Invoicing, following up, recording payments, and highlighting problems like invoice disputes and queries become more stable when your accounting systems are automated. Data from your accounting system, whichever one you use, is immediately pushed into your billing software and you automate your AR routine.

This two-way integration keeps both systems up to date. An automated system relieves the daily grind, allowing systems to run more quickly, efficiently, and user-friendly.

3. Predictable Cash Flow and Lower Bad Debt

Another significant benefit of automating accounts receivable is that your company's cash flow will be predictable. Without automation, your prediction could be completely different from what you're collecting. Further, it will aid in keeping track of your collections process, guaranteeing regular cash flow, and reducing bad debts. It will give you more accurate data on payment notifications, reminders, and emails to ensure timely collection.

4. Standardize your process

In an automated system, every user is on the same accounting page. Hence, there is less chance of confusion when all data sources are the same and everyone is working with the same, up-to-date information. An automated AR system will lead to a consistent cash flow and the company will have speedy data retrieval. If you don't have to worry about your AR process regularly, you can give your staff more time to plan strategies for the future of your company.

5. Ensure Security

When you use a platform that is entirely focused on automating your AR, all of your outgoing invoices are delivered electronically through a single supplier, and regardless of the manner of delivery, this software ensures that you are compliant. Global and local tax compliance and security are ensured by this real-time electronic transmission of original documents and invoicing.

5 Best Practices for Automation of Accounts Receivable Process

1. Involve your accounting department

While selecting automation software for accounts receivables, include your finance team in the process. Automated software will help to organize and reconcile your team's workflows. Creating a system of your workflows will help you find out what you can automate and streamline, as well as what stages you can eliminate to reduce payment friction and simplify billing interactions.

2. Ensure seamless integration of tech stack

Integrating with payment gateways is becoming increasingly important. Almost every firm has payment gateways and accounting software in place before recognizing that the functionality is limited in some areas and that to reach hypergrowth, they need to upgrade to more complete billing software. It will aid in the reduction of payment failures, cut down the manual monotonous work, and improve the reporting systems.

3. Provide incentives for early payments

Establish payment terms that incorporate early payment incentives for customers (or penalties for persistent late payers). If you can afford it, provide discounts for early or upfront payments; you may also reward consumers who accept annual payment plans.

4. Create an AR dashboard

For easier tracking, create dashboards for your AR statistics. Your dedication and discipline in measuring the proper KPIs and spotting insightful trends will determine the difference between a healthy and a not-so-healthy cash flow.

5. Have Integrated Operations

While your major focus is on accounts receivable administration, don't forget that invoicing and revenue recognition are critical components of the overall AR process. Automate your revenue workflow from sales orders to revenue recognition to avoid the complexities of spreadsheets.

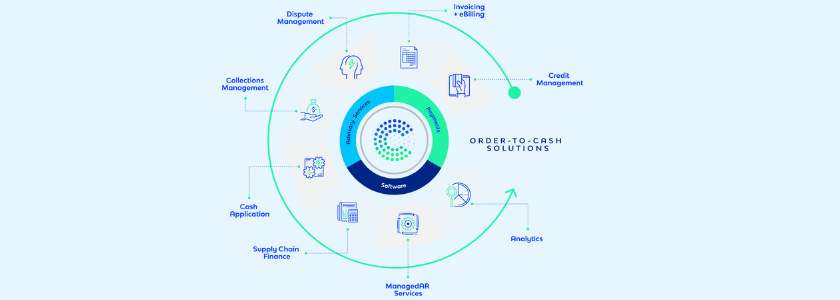

Why Accounts Receivable Outsourcing is the Pragmatic Choice?

When most businesses are faced with difficult cost-cutting options, outsourcing AR appears to be a simple solution. AR outsourcing has the potential to save your firm a significant amount of money. Outsourcing allows you to eliminate fixed overhead costs. You can access more resources with the help of an outsourced AR supplier to enhance your AR process.

AR outsourcing companies would have the tools to effectively integrate it with your system applications. Unlike standard Order-to-Cash SaaS technology solutions, which can take up to 6 months to realize a DSO reduction, outsourcing your AR can lower the timeline for DSO immediately.

Terasol Technologies combines an Order-to-Cash system that ensures DSO reduction and payments, revolutionary centralized billing technology, managed services, and professional knowledge into one product to help suppliers and customers optimize transactions. Contact our experts now, and get an Accounts Receivable system for your business.